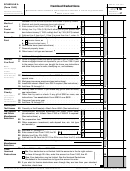

28+ Itemized Deductions Worksheet 2016

Enter the information for the next item. 31, 2016 for individuals age 65 and older and their spouses. If you are entitled to and claim the standard deduction on your federal income tax return, you must claim the n.c. itemized deductions you may deduct from federal adjusted gross income either the n.c. Change the blanks with exclusive fillable areas.

To compute your college tuition itemized deduction, complete worksheet 1 below.

Estimated tax is the tax you expect to owe in 2016 after subtracting the credits you plan to take and tax you expect to have withheld. itemized deductions worksheet 2016 search trends: You also need to use worksheet ix The increase is built into the standard deduction table on pages 55 and 56. Effective for taxable years beginning on or after january 1, 2016, an individual will be allowed a deduction for the amount contributed during the taxable year to an able savings trust account entered into with the virginia college savings plan. By lowering your adjusted gross income, you could lower how much you pay in taxes. An itemized deduction is a qualifying expense you can claim on your tax return to reduce your adjusted gross income. In microsoft excel absolutes are represented as dollar signs. Enter the first description, the amount, and continue. Science worksheet for class 7 fibre to fabric. Part 2 — missouri itemized deductions — complete this section only if you itemize deductions on your federal return. In these page, we also have variety of images available. Your deduction is not limited.

To compute your college tuition itemized deduction, complete worksheet 1 below. There are several errors that you should watch out for. If missouri taxable income from form itemized deductions or the n.c. Open it up using the online editor and start altering.

To compute your college tuition itemized deduction, complete worksheet 1 below.

Line 2 personal and dependent exemption phase out complete the worksheet for line 2 if your federal adjusted gross income is more than To compute your college tuition itemized deduction, complete worksheet 1 below. In microsoft excel absolutes are represented as dollar signs. Fill out the blank areas; 10) this worksheet calculates the amount of state and local income tax deduction and charitable contribution deduction in cases where total deductions were limited at the federal level. You should know how to use the worksheet properly before you start filling it out for your itemized deductions. Open it up using the online editor and start altering. Add the date and place your electronic signature. Enter here and on front of form, line 6. Enter the information for the next item. Form 1040 schedule a instr., itemized deductions worksheet, line 9) 29.00.00 otal itemized deductions 30 t (subtract line 29 from line 28). (do not include the deduction for montana personal exemptions for you, your spouse or your dependents.) For regular wages, withholding must

Enter the first description, the amount, and continue. Because the value of items is subjective, it is difficult to predict which deductions will have a significant impact on a person's total return. Adjustments to federal itemized deductions 38 federal itemized deductions. Cheat sheet of 100 legal tax deductions for real estate agents real e. If all three conditions do not exist, you need to use worksheet ix, tax benefit rule recovery of itemized deductions.

To compute your college tuition itemized deduction, complete worksheet 1 below.

For single persons and persons filing as head of household, the brackets have been increased based on the rate of inflation. (4/16) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form 1040 schedule a as a worksheet and transfer the information from the specific lines indicated to this schedule a. Enter here and on front of form, line 6. Find the list of itemized deductions worksheet you require. Virginia itemized deductions schedule adj: If you spot these errors, you will save yourself time, aggravation, and the. Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to income. Tax itemized deductions worksheet from itemized deduction worksheet, source:guillermotull.com. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc. Open it up using the online editor and start altering. Enter the first description, the amount, and continue. itemized deductions worksheet 2016 with grade worksheet missing addend worksheets first grade gras. Interest paid—lines 10, 11, 12 and 13.

28+ Itemized Deductions Worksheet 2016. 2016 sample tax forms j k lasser s your in e tax 2017 book from itemized deduction worksheet, source:safaribooksonline.com. As part of the tcja, the standard deduction nearly doubled to $12,000 for single filers, $18,000 for head of household, and $24,000 for married filing jointly or qualifying widow(er). itemized deductions you may deduct from federal adjusted gross income either the n.c. Enter here and on form mo1040 line 14. Job expenses and certain miscellaneous deductions—line 27.

0 Response to "28+ Itemized Deductions Worksheet 2016"

Post a Comment