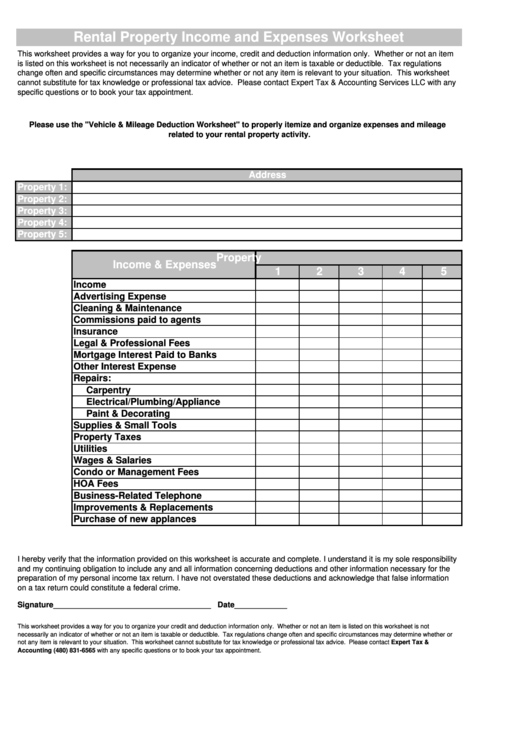

12+ Rental Property Tax Deductions Worksheet

What you can deduct, such as property tax, and what you can’t — but there are defi. What the housing market’s like, how many jobs are available and, of course, how much you’ll pay in property taxes. Besides the property tax deduction, you can claim mortgage interest, repairs, and more. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. Learn how you can deduct your property taxes in this article.

Tax issues when renting out a room in your house find out what tax deduction.

Learn what you can include in your property tax deduction. But the deductions allowed for property taxes include more than just your real estate taxes. Rental property tax deductions are numerous. Tax issues when renting out a room in your house find out what tax deduction. There’s so much more you can do with it than you can do with a rental. In 2018, the average amer. Learn how you can deduct your property taxes in this article. Owning a home is wonderful. If you're a homeowner, you almost certainly have to pay property taxes. If you're looking for a way to bring in some extra income and start saving money for retirement or education expenses, you may consider investing in rental property. As the old adage goes, taxes are a fact of life. Owning a rental property can generate income and some great tax deductions. Unfortunately, owning a home also come.

Can you deduct your property taxes? The part of the property that you occupy is treated as your house, and you can write off anything that you'd write off on as an itemized ded. Owning a home is wonderful. And the more we know about them as adults the easier our finances become. In 2018, the average amer.

Learn how you can deduct your property taxes in this article.

Many of the offers appearing on this sit. What you can deduct, such as property tax, and what you can’t — but there are defi. You can own pets, renovate, mount things to the wall, paint and make many other decisions and changes. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. Get irs form links, too. Rental property tax deductions are numerous. As the old adage goes, taxes are a fact of life. Owning a rental property can generate income and some great tax deductions. Before you jump in to the real estate market, it helps to understand how t. When it comes to property taxes, most people think of the real estate taxes they pay on their home. Besides the property tax deduction, you can claim mortgage interest, repairs, and more. Owning a home is wonderful. If you’re thinking about moving to a new state, you probably want to check out a few details first:

There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. But the deductions allowed for property taxes include more than just your real estate taxes. And the more we know about them as adults the easier our finances become. If you're a homeowner, you almost certainly have to pay property taxes. There’s so much more you can do with it than you can do with a rental.

You can own pets, renovate, mount things to the wall, paint and make many other decisions and changes.

Learn how you can deduct your property taxes in this article. Many of the offers appearing on this sit. Rental property tax deductions are numerous. Tax issues when renting out a room in your house find out what tax deduction. There’s so much more you can do with it than you can do with a rental. When it comes to property taxes, most people think of the real estate taxes they pay on their home. These are local taxes based upon the assessed value of your home. Before you jump in to the real estate market, it helps to understand how t. In 2018, the average amer. If you're a homeowner, you almost certainly have to pay property taxes. The part of the property that you occupy is treated as your house, and you can write off anything that you'd write off on as an itemized ded. What you can deduct, such as property tax, and what you can’t — but there are defi. Besides the property tax deduction, you can claim mortgage interest, repairs, and more.

12+ Rental Property Tax Deductions Worksheet. Howstuffworks.com contributors the money you put into your property taxes goes toward public services provided by your local. Get irs form links, too. As the old adage goes, taxes are a fact of life. Before you jump in to the real estate market, it helps to understand how t. Besides the property tax deduction, you can claim mortgage interest, repairs, and more.

0 Response to "12+ Rental Property Tax Deductions Worksheet"

Post a Comment